Forex for Beginners

Fintechee is an electronic buying and selling platform that was peculiarly developed by Channel-Sea Inc. For Forex trading

. Fintechee became a popular choice among brokers from around and it is still the realm’s most acclimated and usual buying and selling platform up to now.

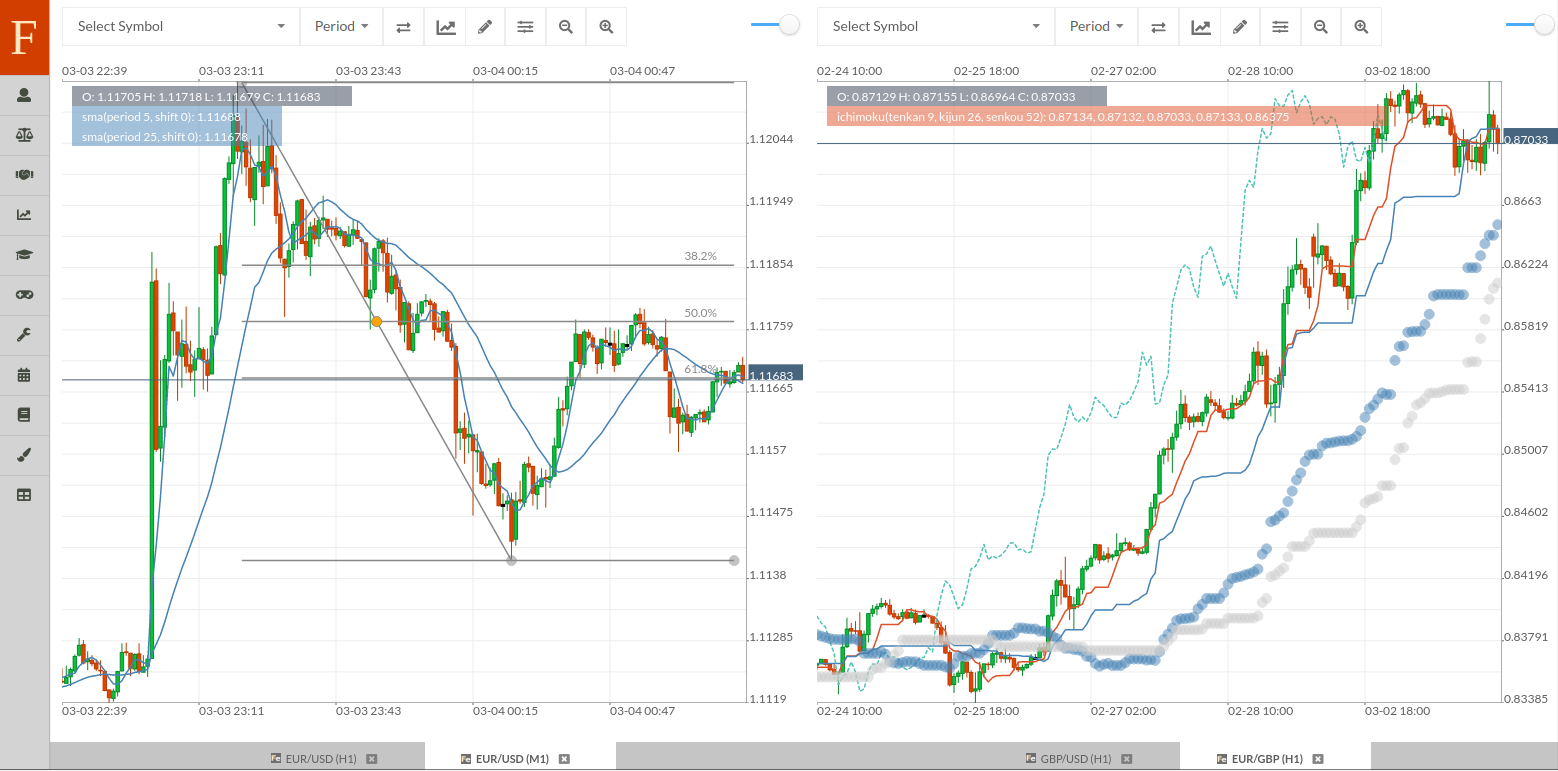

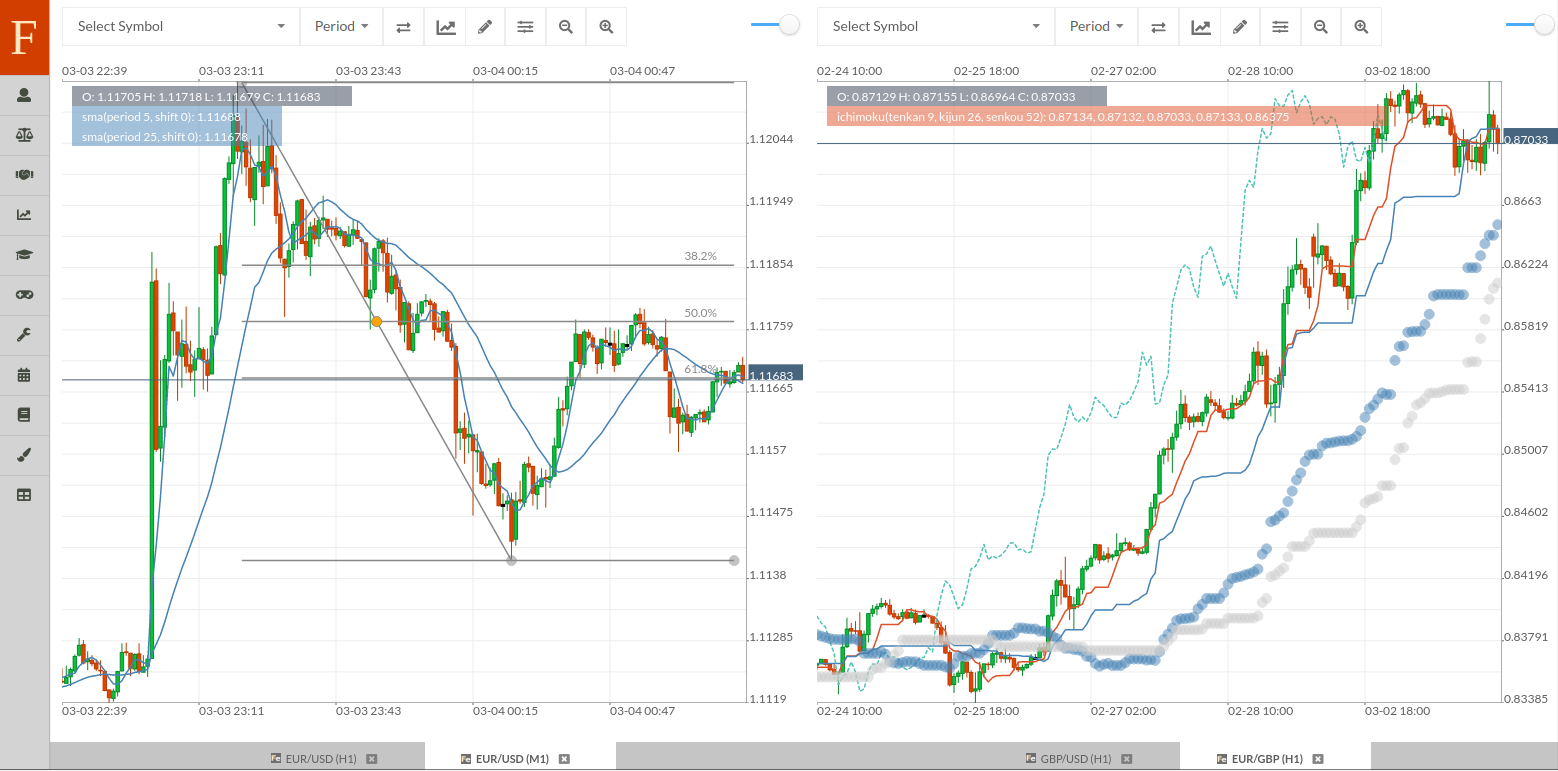

Greater than two-thirds of on-line merchants are the use of cellular platforms at the moment and this reality had accustomed incentives to brokerage agencies to return out with more resourceful and efficient cellular trading software. one of the vital CFD providers that had approved to accept a usual approach is LetsplayFX and today we’ll essay some of the most essential aspects of the Fintechee Chart widget

, Forex broker

white label

.

When I all started alive in the percentage of the market, Bollinger Bands

have been probably the most time-honored choice. Bollinger Bands

are reasonably basic, a moving average shifted up and down via a consumer-certain percent. For example, at any accustomed time, a 7% Bollinger Band includes a nefarious moving average, a higher curve at 107% of the inappropriate and a reduce ambit at 93% of the immoral. Bollinger Bands

had the decided capabilities at the time of actuality handy to a…

In economic facts, examining the moving average MA is an extremely ordinary follow. The direction of the moving average conveys vital information about costs, no matter whether that average is simple or exponential. An ascent moving average suggests that prices are commonly expanding. A falling moving average indicates that expenses, on regular, are falling.

Many traders choose to seem to be on the charts as a simplified technique to determine the buying and selling alternatives – commonly using abstruse warning signs to accomplish that. The MACD indicator

(moving average convergence divergence) and academic symptoms are probably the most commonplace strategies used by traders to determine feasible entry and exit alerts in definite bazaar circumstances.